Open Positions

The table displays the detailed information on the open positions. You can find the way to work with table in the Trading help.

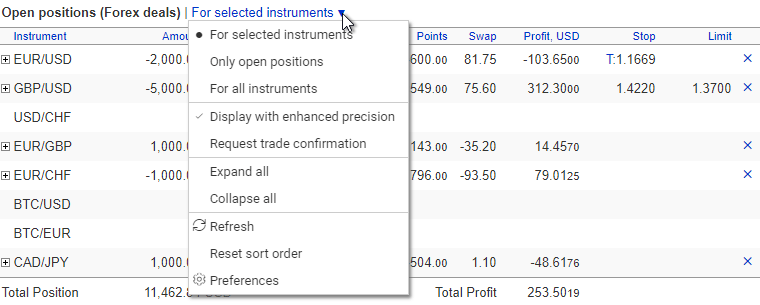

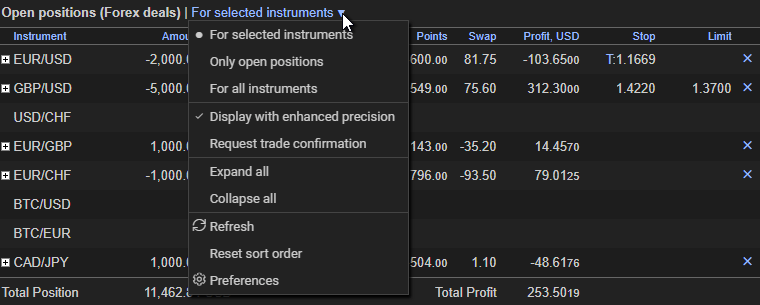

There are three modes to display the positions: For selected instruments (used by default) Only open positions, and For all instruments. The current mode can be seen in the table heading. You can click on the mode name to call out the context menu which allows you to change the display mode or to perform some other actions.

This table can also display the Forex deals, if the option is

enabled in the trading preferences.

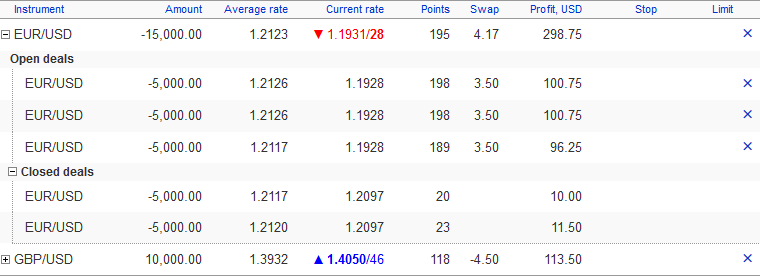

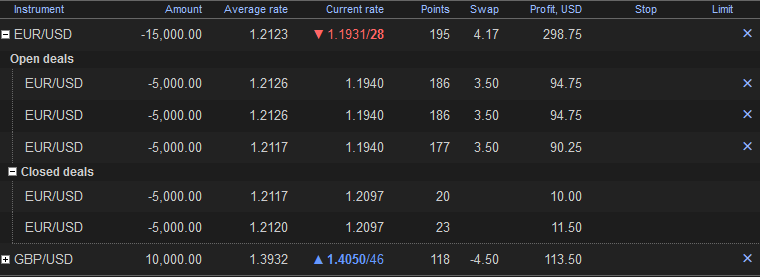

In this case the ![]() bullet appears opposite the instruments there are deals for. When you click on this

bullet, the position row is expanded, and a list of the deals for this instrument is

displayed.

bullet appears opposite the instruments there are deals for. When you click on this

bullet, the position row is expanded, and a list of the deals for this instrument is

displayed.

The quantity of the displayed deals is limited to avoid the list overloading. If it does not show all the open deals then the quantity of the deals not shown is displayed at the bottom of the list as "... 5 more".

A limited quantity of the recently closed deals is shown if the display of the closed deals is enabled. A row with a closed deal usually contains the information of the closed deal (instrument, amount, rate), and that of the closing one (rate, profit). However, if there are multiple deals that were closed with a single deal (for example, at the close of the position on an instrument), then the closing deal is displayed in a separate row.

Note that Conversion trades are not displayed in the Open positions table although they are included in the total open position size. To monitor them, the Currency Balances, Account Statement, and Deals List reports are used.

Notions used in the "Open positions" table.

Amount is the size of an open position on a given instrument. The size of a position is always expressed in the base currency. A positive amount means that a long position (Buy) is opened and a negative amount means opening of a short position (Sell). The deal amount is displayed in this column for the deal rows if the display of the deals is enabled in the preferences. The deal amount is always in the instrument base currency even if you have set it in a quoted currency at a trade execution. This simplifies the calculations, if you want to verify the information in the table.

Average rate is the average rate of opened positions on a given instrument. Calculating the average rate starts at position opening and then the rate is recounted at subsequent trades with the given instrument. When a position is closed out or reversed, the previous average rate value is reset and new calculation starts. The average rate can be displayed with enhanced precision. At that, additional decimal places providing the extra precision are displayed in a smaller font. The way of the average rate calculation as well as the display precision are configured at the Trading Preferences page. The trade execution rate is displayed in this column for the deals.

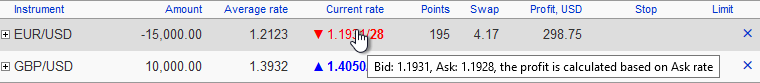

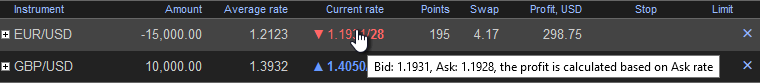

Current rate is a current market rate for a given instrument. Both rates, Bid and Ask, are displayed. The Bid is fully displayed; two last figures for Ask follow after the separator. E.g., the current Bid rate for a certain instrument is 1.3456 and that for Ask is 1.3461, the Rate column shows the value of 1.3456/61.

The rate of either Bid or Ask is used for the calculation depending on the open position sign. For negative positions, the Ask rate is used because to close a position, it is necessary to buy the base currency; for positive positions, it is the Bid rate at which the base currency is sold. The rate used for the calculation is bold.

An indicator appears on the left of the current rate when it changes: ▼ if the rate has decreased compared to the previous value displayed, and ▲ if the rate has increased; the rate itself is displayed in the corresponding color. The indication of changes disappears in about 2 seconds.

This column displays only one rate for the deals. For the open deals it is the rate at which the deal can be closed at the moment, and for the closed ones it is the rate at which the deal has been closed.

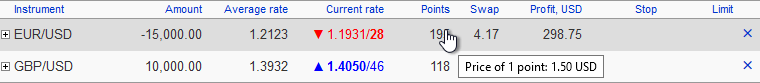

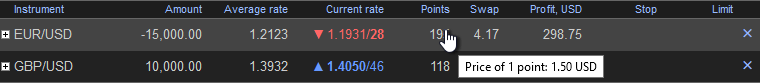

Points is a difference, expressed in points, between a current rate and an average rate for the opening of positions on a given instrument. It usually has the same sign as the current profit (Profit column). Point the mouse cursor onto the value in the column to get a pop-up tip to see the point price.

In the enhanced precision mode, the points difference is displayed with a fractional part. Additional decimal places representing the extra precision are displayed in a smaller font. The rate of either Bid or Ask is used for the calculation depending on the open position sign. It is bold in the Rate column.

Swap is the swap in points charged on the open position or the deal. Point the mouse cursor onto the swap value to get a pop-up tip to see the swap amount in the quoted currency. The swap in points is changed at the open position change while the swap amount remains unchanged.

The swap is charged on the open position each time it is transferred to the next day by a roll-over. The swap size is determined by the trading conditions for the instruments.

The swap is charged on the open deals only if an open position for the deal instrument is not zero, and the deal direction coincides with that of the open position. Swap charged on a deal is calculated from the swap on the position proportionally to the deal amount. Despite the swap is displayed twice, both in the position row and in that of the deal, it is charged once, on the open position.

Profit (current profit) is a profit of loss relating to an open position on a given instrument, calculated at a current market rate and expressed in USD. The positive value corresponds to profit making; the negative one means a loss. To convert into USD, either Bid or Ask is used depending on which of them would have been used for closing the given position. The position is bold in the Rate column. In the enhanced precision mode, additional decimal places representing the extra precision are of a smaller font.

As for the deals, this column also displays profit. For the open deals, this is a floating (unrealized) profit which changes with the current rate change, while for the closed ones it is a fixed (realized) profit received at the deal close.

Stop, Limit – if a position (or a deal) has any tied orders, Stop and/or Limit, to close it, the fields display the rates of the orders. The column is empty if there is no such an order. The amount of the tied orders is opposite to the open position size, and automatically changes at the position change. These orders are automatically canceled at the position close or at its sign change. Only a tied order can close a position or a deal if you trade in the Advanced style; a standalone order placed at the Orders tab always opens a new deal.

You can place the tied orders after the trade execution if you have the Offer order operations option enabled in the trading preferences, or at any time using the context menu.

The x mark in the last column allows you to quickly close the selected position. For a detailed description of this operation see the Help for the Trading page.

Total Position (total open position, current total open position) is an aggregate open position, expressed in USD, relating to all instruments. The total position is used for determining a current leverage, free equity, and minimum equity. The value of the total position depends not only on the open positions relating to Forex trades but also on the availability of negative rests on the account. Therefore, the total open position can be not equal to the sum of open positions on separate instruments. A situation is possible when open positions relating to Forex trades are absent but the total open position is not equal to zero. This can happen, in particular, as a result of sustaining a loss in some currency while trading. If the account preferences have Balance Automatic Conversion turned on (it is on by default), these amounts will be converted into USD at closing of the day and the total open position will become equal to zero.

Total Profit is aggregate current profits or losses relating to open positions on all instruments.